A real-life example of a gross loss in purchasing power

05/16/2022 / By News Editors

One of the most memorable days of my life was when my daughter was born. As any parent instinctively understands, I swelled with so much pride I thought my chest would burst.

(Article by Jeff Clark republished from GoldSilver.com)

Grandma was pretty darn happy, too. And she wanted to contribute to our daughter’s financial future. One of the things she did was buy her granddaughter some US savings bonds.

That was in 1993. And now in 2022 we cashed them in, to help my daughter buy a house. How well did the bonds perform? And how did gold do?

Government Paper vs. Real Money

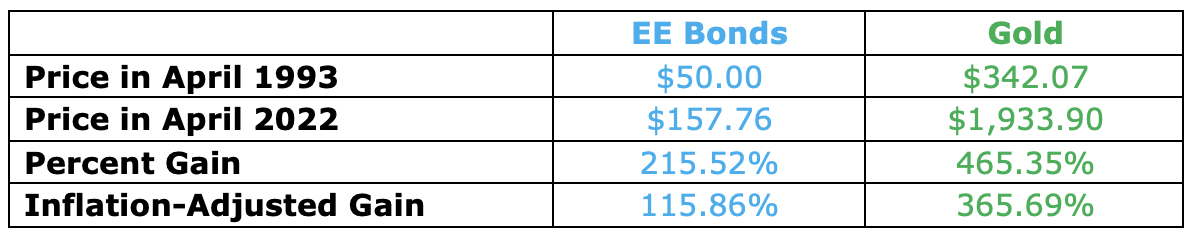

These were United States Series EE Savings Bonds. Most of them had a face value of $100. I learned they were purchased at half face value back then, so Grandma would’ve paid $50 for each of them.

We took them to the bank last month to sell. That’s 29 years of interest, so Grandma assumed it would add up to a substantial amount, given the long timeframe.

The teller logged on to the Treasury site (they actually call it “negotiating” the bond, ha) and informed us “a $100 bond can be cashed in today for $157.76.”

So, a $50 investment into a US savings bond had earned $107.76 in interest. That may or may not sound like a lot to you, but Grandma wasn’t happy; she thought after nearly three decades they’d be worth more.

When I got home, I logged on to CPI inflation Calculator to see what the US government reported as the gain in inflation over the 29-year period. The change in the CPI was +99.66%, meaning the bonds outpaced the “official” rate of inflation.

But that’s using what Mike Maloney affectionately calls the CPLie. I think everyone in America knows inflation is greater than what the government reports.

But the bigger question I had was, how did these manmade, government paper constructs perform against gold?

I looked up gold’s average price in April 1993, calculated the gain, and compared it to the bonds. Here’s what I found.

Gold clearly outperformed government paper. It’s not even close. The “savings” bonds earned less than a third of the purchasing power that gold did.

Consider further that gold is a static metal that doesn’t earn interest, while a bond supposedly accrues, and compounds, interest. Theoretically it should easily outperform gold. It failed to do so.

Here’s the sobering message to all this:

- This isn’t some theoretical exercise—this is real life. These bonds were supposed to help our daughter fund college, buy a car, or in this case contribute to a down payment on a home.

Had Grandma instead purchased gold, our daughter would have more than twice as much currency today to put toward the down-payment.

You wanna save for your children or grandchildren? While in the short-term anything can happen, over the long-term there is no debate here. Gold preserves, even grows, purchasing power. Fiat currency does not.

As Mike has dedicated his life to pointing out, the structure of the current monetary system basically guarantees that gold will be a far superior savings vehicle.

I know what I’ll be buying my grandkids for their savings. I hope you’ll seriously consider what will best preserve and grow your savings in the years ahead, too.

Read more at: GoldSilver.com

Submit a correction >>

Tagged Under:

bubble, currency, currency crash, dollar demise, economy, fiat currency, finance, gold, inflation, money supply, risk, savings bonds

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2021 GoldReport.news

All content posted on this site is protected under Free Speech. GoldReport.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. GoldReport.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.